SR-22 Insurance in Washington State • Owners & Non-Owner SR22

Suspended License? Get SR22 Insurance Now. Get Your Driver’s License Back Fast!

Most of us need to drive in order to get to work, to run errands, and to do all that other stuff in life. If you have lost your license due to some driving mishap there are a number of things you will need to do to get your license back and one of them is to file an SR22 with the state.Everything you need to know about SR22 Insurance

- What is SR-22 Insurance?

- Is an SR22 Insurance considered car insurance?

- I Don’t Own a Car – Can I Get SR-22 Insurance?

- How to Get SR22 Insurance?

- Where Can I Find Cheap SR-22 Insurance?

- Does SR22 Increase Insurance Rates?

- Can My Current Agent File My SR-22 Insurance?

- How Long Do I Need to Carry My SR22 Insurance?

- What Happens If I Cancel My SR-22 Insurance?

- How Can I Get the Lowest SR22 Insurance Rates?

- Can I Get An SR-22 Insurance Without Having Car Insurance?

Free SR22 Insurance Quotes – Same Day Coverage

If you’re told you need to get an SR22 Insurance quote would you know what to do? Breathe easy, SR-22 Insurance is our specialty. Mid-Columbia Insurance can take care of filing the SR22 form for you. Need SR-22 Insurance and no car? No Problem! Let us be your insurance finders. If you are dealing with a DUI or other major tickets then getting SR22 Insurance is most likely your next step to getting your license back and being able to drive your car legally. Mid-Columbia Insurance serves all of Washington state and is the SR-22 Insurance expert. We can write a Progressive SR22, National General SR22, Dairyland SR22, Kemper SR22, Safeco SR22, Bristol West SR22, The General SR22, and more for you.Request An SR22 Insurance Quote

Disclaimer: By requesting a quote, I am providing my express written consent to Mid-Columbia Insurance to work up an insurance quote for me and to contact me by phone, text message, and email at the phone number and email address provided. Additionally, I acknowledge that I have read, understood, and agree to Mid-Columbia Insurance’s Privacy Policy.What Our Customers Are Saying About Us

What is the difference between SR22 Insurance and Regular Car Insurance?

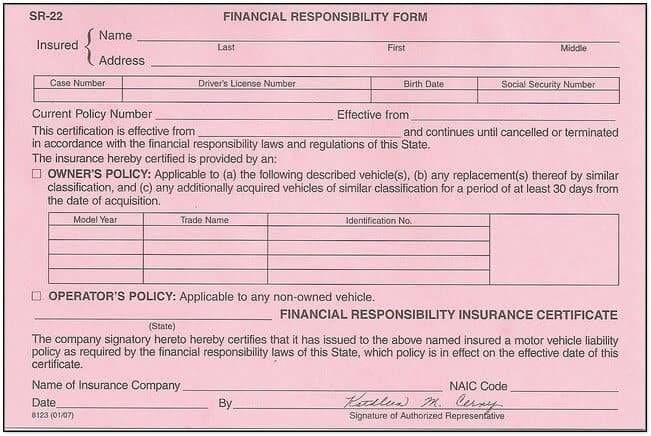

What is SR22 Insurance Filing / Financial Responsibility?

Is SR22 Insurance Considered Car Insurance?

Can I Get SR22 Insurance If I Don’t Own a Car?

How Do I Get SR22 Insurance?

Where Can I Find Cheap SR22 Insurance?

Does SR22 Increase Insurance Rates?

Can My Current Agent Handle My SR22 Insurance?

How Long Do I Need To Have SR22 Insurance?

What Happens If I Cancel My SR22 Insurance?

How Can I Get the Cheapest SR22 Insurance Price?

Can I Get An SR22 Insurance Without Having Car Insurance?

Recent SR22 Posts

DUI, SR22, and Cheap Car Insurance

You got a DUI, Now what? Relax, you just found an insurance agency that won’t judge and understands what you're going through. If it is your first DUI, you will probably have to pay a fine, get an SR22 filing to get your driver’s license unsuspended, and have an...

How Much Does Washington SR22 Insurance Cost?

Find Cheap SR22 Insurance Quotes Whether your current insurer will file an SR-22 for you or not, one of the easiest ways to make sure you're getting the most affordable SR-22 coverage is to compare quotes from multiple companies, which is something we can do for you....

Washington DUI Laws: Alcohol, Cannabis, and Drugs

Washington’s DUI statute prohibits driving while affected by alcohol, cannabis, or drugs. Convictions can result from per se limits or impairment evidence. Drivers have a few defenses available.

Major Changes Coming to Washington’s DUI Laws in 2026

Washington state will revise its approach to prosecuting and sentencing DUIs in 2026. ESHB 1493 creates a sentencing alternative for felony DUIs, allows some repeat offenders a second deferred prosecution, and makes other significant changes.

DUI Blood Draws Now by Washington State Troopers

Sounds like WA State Patrol will be able to draw blood from suspected DUI drivers right on the side of the road. A quick call to get a warrant and a Trooper who has now received the proper training can take a blood sample right there and then. No longer will they have...

DUI Suspect Found In Yard. Now It’s SR22 Time Not Miller Time

Kennewick Police on Facebook: Last night officers responded to a report of a vehicle parked in a citizens yard. On arrival, officers discovered the vehicle had driven into a power line pole, skid through a chain link fence, and came to a stop in a yard and driveway....