The recent announcements by the ten largest auto insurers of rate increases entering double-digit percentages have raised important questions regarding the reasons behind such significant increases.

These increases will affect the economy and consumer behavior as families reassess their budgets and strategies for managing auto insurance costs.

The economic and risk-related factors influencing the auto insurance sector’s recalibration are complex. Understanding these factors is crucial because they affect policyholders and the economy.

Key Takeaways

- The top ten largest auto insurers recently announced rate increases that have entered double-digit percentages. This significant development suggests a major shift in the insurance industry, extending beyond typical inflation or operating cost adjustments. The reasons for these rate hikes are multifaceted, involving economic and risk-related factors. These factors are complex but are at the core of why insurers have recalibrated their rates.

- Understanding the causes of these rate hikes is essential. It helps us grasp the potential impact on both the economy and the behavior of consumers. For instance, due to these changes, families might have to reevaluate how they budget for auto insurance expenses. If policyholders find these increased rates challenging, it could affect their financial stability.

- The conversation about the implications of these rate hikes is crucial. It aims to clarify what these changes could mean for the future of auto insurance pricing. By discussing these implications, we can better understand the effects on consumers and the broader economic trends influencing the auto insurance market.

The Trend of Rising Premiums

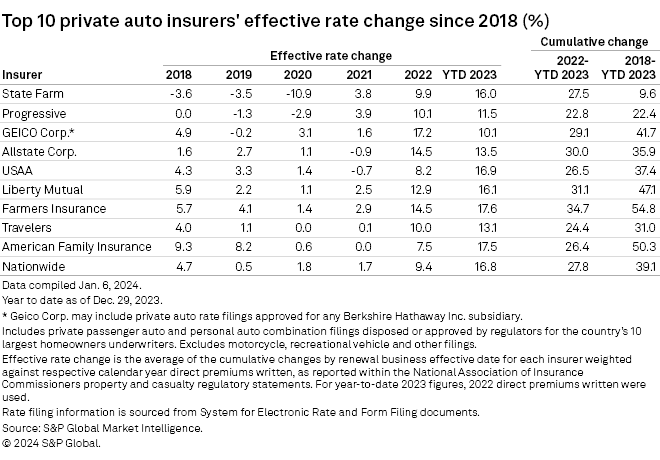

In 2024, auto insurance premiums will continue to increase, directly affecting how much consumers pay for their auto insurance coverage. Farmers Insurance has taken the lead by raising their rates by 17.6%. This significant increase is more than just a one-time adjustment; it reflects a consistent pattern that affects how policyholders manage their budgets. They may seek cheaper insurance options or change their coverage scope to ease the financial burden.

The reasons for these premium hikes are diverse. They include the frequency of severe auto crashes, the prevalence of extreme weather conditions, and a surge in vehicle thefts. All these factors contribute to more significant losses. Because such losses can threaten the profitability of insurance companies, these firms are adjusting their premiums to ensure their financial stability.

The impact of these insurance rate increases varies by state, with Nevada experiencing an incredibly high rate hike of 28.3%. This disparity in rate changes can shape how competitive insurance companies are as they strive to keep customers satisfied and maintain or grow their market share in various locations.

Given this situation, consumers should actively review their current auto insurance policies and compare them with what other companies offer. The insurance industry’s competitive nature might provide chances to find more advantageous rates, even as the overall trend points to higher premiums.

Factors Driving Rate Increases

As we consider the reasons for the increase in insurance premiums, it is evident that the growth in the number and severity of auto crashes has played a significant role. The trend of rising premiums directly results from more frequent claims and the heightened severity of auto accidents. Insurance companies face the twofold challenge of managing rising costs while trying to keep their customers.

The escalation in serious auto accidents and vehicle thefts has resulted in more claims, prompting insurers to apply more stringent risk assessments. The insurance market is also experiencing more frequent severe weather events, leading to more significant losses. These events, together with an increase in the number of claims going to court, have pressured insurance providers to adjust their rates to cover the growing costs of claims. The effect on consumers is significant, with policyholders shouldering the burden of increased premiums.

Auto insurers adjust their rates to address the rising claim frequency and severity and the financial effects of severe weather and theft. These adjustments are essential for maintaining their operations’ financial stability and ability to deliver services to customers efficiently. Insurers strive to maintain customer loyalty by offering value that justifies the rate adjustments despite their challenging conditions.

Impact on Consumer Budgets

The significant increases in auto insurance rates in 2023 put considerable pressure on consumer household budgets. Specifically, insurance premiums in Nevada, Minnesota, and Washington have risen by over 10%, causing financial strain for many drivers. These heightened costs demand a significant portion of monthly income, leading to tighter financial conditions for individuals.

This table presents a clear picture of the challenges consumers are currently facing:

| State | Rate Increase | Impact on Consumer Budgets |

|---|---|---|

| Nevada | Over 10% | Notable financial constraints |

| Minnesota | Over 10% | Elevated consumer financial stress |

| Washington | Over 10% | Increased economic pressure |

These rate hikes are not merely numbers; they significantly affect how consumers allocate their monthly income and make it necessary for individuals to monitor their financial planning closely. The growing cost of auto insurance premiums may also influence broader economic patterns by reducing consumer spending power.

As these insurance rate increases affect affordability, it is crucial for consumers to actively seek out competitive insurance rates and consider revising their budgets to manage their financial well-being. This situation highlights the need for individuals to be vigilant in the marketplace and to enhance their understanding of financial matters to navigate the challenges posed by rising auto insurance costs.

Shopping for Competitive Rates

Consumers must shop around for competitive rates in response to the escalating auto insurance rates. This action helps to reduce the strain on their finances by finding more manageable payment options. When we examine the current trends in insurance premiums, which show an increase among major insurers, we realize the importance of being proactive in purchasing auto insurance.

Consumers are encouraged to talk with an independent agent who can shop multiple companies. These agents compare different insurance rates and coverages, offering a way to ease the financial burden.

Additionally, comparison shopping provides a distinct satisfaction even if you discover better rates are unavailable. This satisfaction boosts our confidence in making smart financial choices. By exploring various insurers through an independent insurance agent, consumers may find a company that offers more favorable rates or discounts.

Consumers need to use the online tools and resources available to understand the current trends in insurance premiums fully. This understanding is about more than just identifying the cheapest option. It also involves comprehending each policy’s value and coverage, ensuring they make an informed choice.

Ultimately, consumers can protect themselves from the impact of industry-wide rate increases by shopping for auto insurance with thoroughness and intention. Through careful research and comparison, individuals can safeguard themselves from feeling unfairly impacted by these cost escalations.

State-by-State Variations

In 2023, auto insurance rates will vary significantly across different states, reflecting a trend of region-specific changes in premiums. The national average for auto insurance increases has been exceeded significantly by some states, which is evident when comparing state-level data.

Notably, Nevada has experienced the highest increase, with auto insurance premiums rising by 28.3%.

Other states, such as Minnesota and Washington, have also faced considerable increases in auto insurance rates, with both nearing a 20% upsurge. These significant jumps in premiums place a heavier financial load on the residents of these states.

Consumers need to be aware of the differences in auto insurance pricing. Such knowledge is essential for making well-informed choices when selecting an auto insurance provider. Recognizing the influence of regional factors on insurance costs is critical, as this can affect the overall affordability of auto insurance.

Insurance Rate Regulation

Insurance rate regulation is crucial because it prevents unfair premium hikes and ensures the insurance market is competitive and financially stable. Three fundamental principles govern this regulation:

The principle of consumer protection focuses on preventing policyholders from being exploited by excessive rates. It mandates that any premium increase must be justified and communicated clearly. This principle is crucial because it helps maintain trust in the insurance system and shields consumers from financial strain.

Fair pricing is a principle that requires insurance premiums based on accurate actuarial data and proper risk assessment. This principle ensures that the cost of coverage accurately reflects the risk involved. This principle’s importance lies in fostering a fair market where prices are based on objective criteria, not arbitrary decisions.

The financial solvency principle averts the adoption of risky business practices that could lead to an insurer’s inability to pay claims. This principle protects the consumer by ensuring they receive fair compensation and the industry by promoting stable insurance companies.

State regulatory bodies enforce these principles by thoroughly reviewing proposed rate changes. They require insurers to submit detailed actuarial data that supports their rate adjustments. This process is essential in preventing the exploitation of consumers and allows insurance companies to adjust to market changes while remaining financially sound.

Strategies to Offset Costs

Consumers can adopt several strategies to cope with the financial strain of rising insurance premiums.

Policyholders need to claim all discounts they qualify for, such as those awarded for being a safe driver, achieving good academic performance as a student, or completing a defensive driving course, as these discounts can decrease insurance costs.

Managing deductibles effectively is a valuable strategy to control insurance expenses. Opting for higher deductibles usually reduces premium costs, but policyholders must ensure they can afford them when filing a claim.

Comparing insurance quotes through an independent insurance agent allows consumers to find the best rates and coverage that meet their individual needs, which is essential in a market where prices vary widely.

The Role of Telematics

Telematics technology is crucial in reshaping auto insurance by delivering personalized insights into driving habits. This technology enables insurers to analyze driving behavior thoroughly. As a result, insurance companies can assess risks more accurately and tailor their rates more closely to individual risk profiles.

Here are some key impacts of telematics on insurance:

- Personalized Pricing: Safe drivers, as identified through telematics data, often receive the benefit of lower insurance premiums. This personalized pricing can help counterbalance the trend of increasing insurance rates, offering a financial incentive for cautious driving.

- Safer Driving Incentives: Telematics technology promotes road safety by rewarding drivers who follow safe driving practices. This incentive can result in a decrease in accidents and, subsequently, a reduction in insurance claims.

- Data-Driven Decisions: Telematics allows insurers to base their policy pricing and risk management on solid data. This approach ensures that insurance premiums are more reflective of the actual risk rather than broad demographic indicators.

While telematics offers considerable benefits, protecting and using personal driving data raises privacy concerns. Insurers must manage these concerns with clear communication and robust data protection strategies. By doing so, they can build trust with their clients and deliver services that balance telematics technology’s enhanced security and benefits.

Future Projections for Insurers

Insurers are forecasted to focus on innovation and strategic risk management to remain profitable and keep customers satisfied in the future. This emphasis arises from addressing challenges like rate increases due to severe weather, vehicle theft escalation, and increased claims litigation.

Technological advancements hold a crucial position in the future of auto insurance. Insurers expect to adopt telematics and advanced analytics extensively. These technologies enable insurers to set policy prices based on individual driving behaviors, which may lead to fewer claims and enhanced customer satisfaction through more personalized service offerings.

Insurers aim to balance rate adjustments with customer retention and attraction in the face of growing market competition. This balance is essential because it allows insurers to stay competitive while managing risk effectively. To achieve this, insurers may improve customer experiences, simplify claims processes, and upgrade digital tools.

Sophisticated risk assessment is essential, as underscored by the industry’s move towards predictive modeling, which helps companies anticipate trends and prepare for market changes in advance.

Conclusion

The recent double-digit auto insurance rate hikes reflect a significant industry shift driven by rising risks and costs. Insurers embrace innovation as consumers deal with growing financial strain, and regulators balance these interests.

While the full implications will emerge over time, individuals can respond by shopping for competitive pricing, managing budgets carefully, and tracking state-level changes. Though frustrating, these rate hikes provide an impetus to reevaluate assumptions and seek solutions toward equilibrium.

Ultimately, consumers and insurers will need to actively navigate the challenges ahead in pursuit of affordability and stability.

Sources:

Mid-Columbia Insurance – Your Trusted Insurance Agent

Call (509)783-5600 and speak to one of our independent insurance agent professionals today, or click “Get a Quote” to request an insurance quote.

Get the insurance you want at a price you can afford!