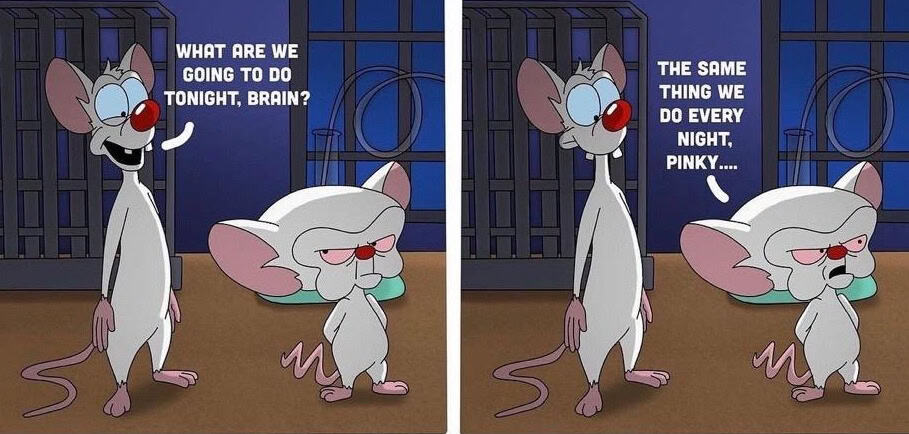

Pinky: “Gee, Brain, what do you want to do tonight?”

Brain: “The same thing we do every night, Pinky – try to take over the world! But first, we need to educate the masses about the importance of Uninsured Motorist coverage in their auto insurance policies.”

Pinky: “Egad, Brain! Brilliant! But wait, what’s this Uninsured Motorist thingy?”

Brain: “Allow me to explain, Pinky. Imagine a world where a single mother of two, minding her own business, is suddenly struck by a reckless driver who runs a red light. The impact is so severe that our unsuspecting protagonist suffers multiple fractures and finds herself in the hospital, facing a staggering $95,000 in medical bills.”

Pinky: “Oh, no! That’s terrible, Brain! But won’t her auto insurance cover the expenses?”

Brain: “It’s not that simple, Pinky. If the at-fault driver has little or no insurance, our protagonist might be left to foot the bill herself. That’s where Uninsured/Underinsured Motorist coverage comes in. It protects you when the other driver’s insurance is insufficient or nonexistent.”

Pinky: “Narf! That sounds like a brilliant plan, Brain! But why don’t more people have this coverage?”

Brain: “Elementary, my dear Pinky. Many people are simply unaware of how affordable it is to obtain substantially more protection. For a relatively small additional premium, one can significantly increase their family’s financial security.”

Pinky: “Zort! So, what should people do, Brain?”

Brain: “It’s quite simple, Pinky. First, they must locate their auto insurance policy and review the ‘Declarations Page’ to determine their current coverage. If their Uninsured/Underinsured Motorist limits are less than $250,000, they should immediately contact their insurance agent and inquire about increasing their coverage to at least $250,000 per person and $500,000 per accident.”

Pinky: “Troz! And what if they can’t figure out their policy, Brain?”

Brain: “In that case, Pinky, they should contact Mid-Columbia Insurance and send a copy of their policy and request a no-cost policy review. They would be more than happy to assist them in understanding their coverage and exploring various options.”

Pinky: “Narf! Brain, this all seems so important! What’s the next step in our plan to take over the world?”

Brain: “Patience, Pinky. For now, we focus on spreading the word about the critical importance of Uninsured Motorist coverage. One well-protected driver at a time, we shall create a world where financial ruin from unexpected accidents is a thing of the past. And then, Pinky, the world will be ours for the taking!”

Pinky: “Egad, Brain! Brilliant! Narf!”

* Disclaimer: This article is a parody and is not associated with or endorsed by the creators, owners, or distributors of the animated series “Pinky and the Brain.” The characters’ names, likenesses, and catchphrases used in this parody are the intellectual property of Warner Bros. Entertainment Inc.

This parody article is intended for entertainment purposes only and aims to educate readers about the importance of Uninsured/Underinsured Motorist coverage in a lighthearted manner.

The views and opinions expressed in this parody do not necessarily reflect those of Warner Bros. Entertainment Inc., the original creators of “Pinky and the Brain,” or any other party involved in the production and distribution of the series. No copyright infringement is intended, and the author of this parody acknowledges and respects the intellectual property rights of all parties involved.

Mid-Columbia Insurance

– Your Trusted Insurance Agent

Our team of experienced agents, representing trusted insurers like Safeco, Progressive, National General, Dairyland, The General, Bristol West, and Foremost, is committed to helping you find the right coverage to protect you and your vehicle and provide peace of mind.

Contact us today at (509)783-5600 or click “Get a Quote” to learn more about our affordable auto insurance options and how we can help you safeguard your financial future against one random accident.

The insurance you want — At a price you can afford.