Tacoma SR-22 Insurance: Affordable Coverage Made Easy

If you find yourself needing SR-22 insurance in Tacoma, Washington, you might be feeling overwhelmed and unsure of where to turn. At Mid-Columbia Insurance, we understand the challenges that come with securing affordable SR-22 coverage, and we’re here to help.

With over 25 years of experience in assisting clients with their SR-22 needs, we have the knowledge and expertise to guide you through the process and get you back on the road.

Call Now for Quote!

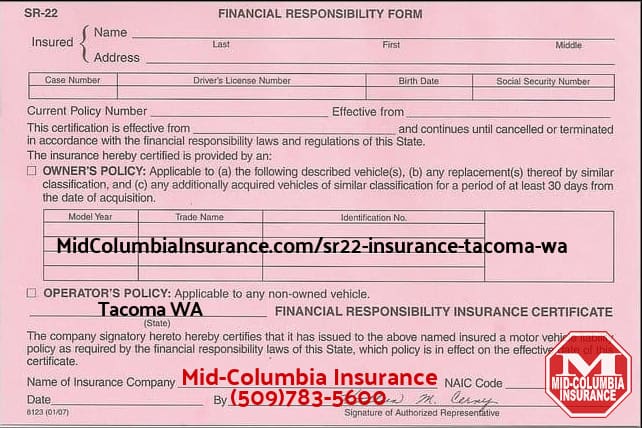

What is SR-22 Insurance?

SR-22 insurance is a special type of car insurance required for drivers who have had their license suspended due to certain traffic violations or offenses, such as DUI convictions, reckless driving, or driving without insurance. The SR-22 form is a certificate of financial responsibility filed by your insurance company with the Washington State Department of Licensing to verify that you are carrying the minimum liability coverage required by state law.

It’s important to note that SR-22 insurance is not a separate policy, but rather an endorsement added to your existing auto insurance policy. This endorsement serves as proof that you have the necessary insurance coverage to legally operate a vehicle in Washington state.

Who Needs SR-22 Insurance in Tacoma?

Drivers in Tacoma may be required to obtain SR-22 insurance for a variety of reasons, including:

- DUI or DWI convictions: If you have been convicted of driving under the influence of drugs or alcohol, you will likely need to file an SR-22.

- Reckless driving: Repeatedly engaging in dangerous driving behaviors can result in the need for an SR-22.

- Driving without insurance: If you are caught operating a vehicle without the required insurance coverage, you may be mandated to obtain SR-22 insurance.

- Multiple traffic violations: Accumulating a certain number of moving violations within a specified timeframe can trigger the SR-22 requirement.

- License suspension or revocation: If your driver’s license has been suspended or revoked for any reason, you may need to file an SR-22 to have it reinstated.

If you find yourself in any of these situations, it’s crucial to take action quickly to secure SR-22 insurance and avoid further penalties or legal consequences.

Request An SR22 Insurance Quote

Disclaimer: By requesting a quote, I am providing my express written consent to Mid-Columbia Insurance to work up an insurance quote for me and to contact me by phone, text message, and email at the phone number and email address provided. Additionally, I acknowledge that I have read, understood, and agree to Mid-Columbia Insurance’s Privacy Policy.What Our Customers Are Saying About Us

How Long Do I Need to Maintain SR-22 Insurance?

In most cases, drivers in Washington state are required to maintain continuous SR-22 coverage for a period of three years. This means that you must keep your insurance policy active and up-to-date during this time, with no lapses in coverage. If you fail to maintain your SR-22 insurance, your insurance company is obligated to notify the Department of Licensing, which can result in the suspension of your driving privileges.

It’s essential to work closely with your insurance provider to ensure that your SR-22 filing remains in good standing throughout the required period. At Mid-Columbia Insurance, we’re committed to helping our clients navigate the complexities of SR-22 insurance and providing the support they need to maintain compliance with state regulations.

How Much Does SR-22 Insurance Cost in Tacoma?

The cost of SR-22 insurance in Tacoma can vary depending on several factors, including your driving record, the severity of your violations, and the insurance company you choose. In general, drivers who require SR-22 filings are considered high-risk and may face higher insurance premiums compared to those with clean driving records.

However, at Mid-Columbia Insurance, we work hard to find our clients the most affordable SR-22 insurance options available. We partner with top insurance carriers like Progressive, National General, Dairyland, The General, and Bristol West to ensure that you have access to competitive rates and reliable coverage.

On average, Tacoma drivers can expect to pay between $150 and $300 per month for SR-22 insurance, although this can vary widely based on individual circumstances. In addition to your monthly premium, you may also be responsible for a one-time SR-22 filing fee, which typically ranges from $20 to $50.

What Are the Minimum SR-22 Insurance Requirements in Washington?

To satisfy the SR-22 requirements in Washington state, you must maintain the following minimum liability coverage:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury Liability (per person) | $25,000 |

| Bodily Injury Liability (per accident) | $50,000 |

| Property Damage Liability | $10,000 |

It’s important to note that these are only the minimum requirements, and it may be wise to consider purchasing higher limits to provide greater protection for yourself and others in the event of an accident.

What If I Don’t Own a Vehicle?

If you need to file an SR-22 but don’t own a vehicle, you may be required to obtain a broad form or on-owner SR-22 policy. This type of policy provides liability coverage when you drive a borrowed or rented vehicle, ensuring that you meet the state’s financial responsibility requirements even if you don’t have a car of your own.

At Mid-Columbia Insurance, we can help you secure a non-owner SR-22 policy that fits your unique needs and budget. Our knowledgeable agents will work with you to find the best coverage options available and guide you through the filing process.

The Importance of Working with a Trusted Insurance Agency

When it comes to obtaining SR-22 insurance in Tacoma, it’s crucial to work with a reputable and experienced insurance agency like Mid-Columbia Insurance. Our team of dedicated professionals understands the unique challenges faced by drivers who require SR-22 filings, and we’re committed to providing personalized service and expert guidance every step of the way.

As Gary Paulson, owner of Mid-Columbia Insurance, explains, “We believe in treating our clients with the utmost respect and compassion, no matter what their driving history may be. Our goal is to help them navigate the complex world of SR-22 insurance and get back on the road as quickly and affordably as possible.”

By choosing Mid-Columbia Insurance for your SR-22 needs, you can benefit from:

- Extensive experience handling SR-22 filings in Washington state

- Access to multiple top-rated insurance carriers

- Competitive rates and flexible payment options

- Personalized service and one-on-one support

- Convenient online tools and resources

Don’t let the need for SR-22 insurance hold you back from moving forward with your life. Contact Mid-Columbia Insurance today to learn more about our comprehensive SR-22 services and request a free, no-obligation quote. Our friendly and knowledgeable agents are here to answer your questions, address your concerns, and help you find the best coverage options for your unique situation.

Mid-Columbia Insurance

– Your Trusted SR-22 Insurance Agent

At Mid-Columbia Insurance, we understand that needing SR-22 insurance can be a stressful and overwhelming experience. That’s why we’re here to make the process as simple and stress-free as possible. With our expert guidance and personalized service, you can rest assured that you’re getting the best possible coverage at the most affordable rates.

Call us at (509)783-5600, visit our office, or click “Get a Quote” to request a quote online to begin the process of obtaining SR22 insurance in Tacoma, WA. We look forward to serving you and helping you move forward with confidence.

The insurance you want — At a price you can afford.

Frequently Asked Questions

| Question | Answer |

|---|---|

| How do I know if I need SR-22 insurance in Tacoma? | If you have been notified by the Washington State Department of Licensing or a court order that you require an SR-22 filing, then you need to obtain SR-22 insurance. Common reasons include DUI convictions, reckless driving, or driving without insurance. |

| Can I get SR-22 insurance if I don’t own a car? | Yes, you can obtain a broad form or on-owner SR-22 policy if you need to file an SR-22 but don’t own a vehicle. This type of policy provides liability coverage when you drive a borrowed or rented car. |

| How long does it take to process an SR-22 filing in Tacoma? | Processing times for SR-22 filings can vary, but typically it takes 1-2 business days for the insurance company to file the SR-22 with the Department of Licensing once you have purchased the policy. |

| What happens if I let my SR-22 insurance lapse? | If you fail to maintain continuous SR-22 coverage during the required period, your insurance company will notify the Department of Licensing, and your driving privileges may be suspended. It’s crucial to keep your policy active and up-to-date. |

| Can I cancel my SR-22 insurance once I’ve filed it? | You should not cancel your SR-22 insurance until the filing requirement period has ended, which is typically three years in Washington state. Canceling your policy early can result in the suspension of your driving privileges. |

| How much does SR-22 insurance cost compared to regular insurance? | The cost of SR-22 insurance varies depending on factors such as your driving record and the insurance company you choose. However, drivers who require SR-22 filings are generally considered high-risk and may pay higher premiums than those with clean records. |

| Are there any additional fees associated with SR-22 insurance? | In addition to your insurance premium, you may be required to pay a one-time SR-22 filing fee, which typically ranges from $20 to $50. This fee covers the administrative costs of filing the SR-22 with the state. |

| What should I do if I move out of state while carrying SR-22 insurance? | If you move out of Washington state during your SR-22 filing period, you should contact your insurance provider to discuss your options. You may need to obtain a new SR-22 filing in your new state of residence. |

| Can I get SR-22 insurance with a learner’s permit in Tacoma? | Yes, if you have a learner’s permit and are required to file an SR-22, you can obtain insurance coverage. However, the policy may have certain restrictions, such as requiring a licensed adult to be in the vehicle when you drive. |

| How do I know when my SR-22 filing period is over? | Your SR-22 filing period typically ends three years from the date your license suspension or revocation is lifted. You can contact the Washington State Department of Licensing to confirm your filing period’s end date. |