Spokane Washington SR-22 Insurance | Affordable Quotes

What is SR22 Insurance?

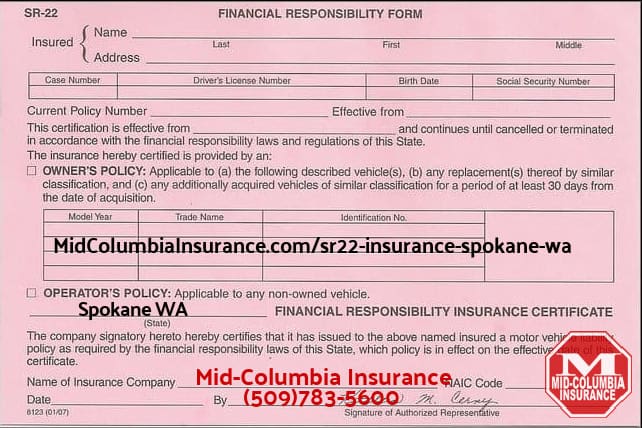

SR22 insurance is a Certificate of Financial Responsibility that proves you carry the minimum liability insurance required by the state of Washington. It’s not a separate insurance policy but rather a filing that your insurance company sends to the DOL on your behalf. The SR22 filing is typically required for drivers who have had their license suspended due to certain high-risk driving offenses, such as:

- DUI/DWI convictions

- Reckless driving

- Driving without insurance

- Multiple traffic violations within a short period

- At-fault accidents while uninsured

Who Needs SR-22 Insurance in Spokane?

If you’ve been notified by the Washington Department of Licensing that you need to file an SR-22, you’ll need to obtain this coverage to reinstate your driving privileges. Some common reasons drivers in Spokane may need SR-22 insurance include:

- Reinstating a suspended license after a DUI or other high-risk offense

- Proving financial responsibility after an at-fault accident while uninsured

- Satisfying a court order related to a traffic violation

- Maintaining continuous insurance coverage after a lapse

Request An SR22 Insurance Quote

Disclaimer: By requesting a quote, I am providing my express written consent to Mid-Columbia Insurance to work up an insurance quote for me and to contact me by phone, text message, and email at the phone number and email address provided. Additionally, I acknowledge that I have read, understood, and agree to Mid-Columbia Insurance’s Privacy Policy.

How to Obtain SR22 Insurance in Spokane

To get SR22 insurance in Spokane, you’ll need to follow these steps:

- Contact an independent insurance agency such as Mid-Columbia Insurance that specializes in SR22 filings and high-risk driver insurance in Washington state. Mid-Columbia Insurance partners with the following companies to offer SR22 insurance in Spokane:

- Request an SR22 filing from your insurance provider. You’ll typically need to pay a one-time filing fee of around $25.

- Maintain your SR22 insurance policy for the required period, typically three years. If you let your coverage lapse during this time, your insurance company will notify the DOL, and your license may be suspended again.

- Once you’ve completed the SR22 requirement period, you can contact your insurance provider to have the filing removed and potentially qualify for lower rates.

Types of SR-22 Insurance in Spokane

There are two main types of SR-22 insurance available in Spokane:

- Owner SR-22: This type of filing is required if you own a vehicle and need to reinstate your license. It covers you and any vehicle you own.

- Non-Owner SR-22: If you don’t own a vehicle but still need to reinstate your license, you can obtain a non-owner SR-22 policy. This type of coverage, also known as Broad Form insurance, covers you when driving vehicles you don’t own, such as a rental car or a borrowed vehicle from a friend or family member.

Mid-Columbia Insurance offers both owner and non-owner SR-22 insurance policies, making it easy for Spokane drivers to find the coverage they need to get back on the road.

Washington State SR-22 Insurance Requirements

In Washington state, the minimum liability coverage required for an SR-22 filing is:

- $25,000 per person for bodily injury liability

- $50,000 per accident for bodily injury liability

- $10,000 per accident for property damage liability

However, it’s important to note that these are only the minimum requirements, and it’s often recommended to carry higher limits for added protection. The experienced agents at Mid-Columbia Insurance can help you determine the right coverage levels for your unique situation.

Maintaining SR22 Insurance in Spokane

Once you’ve obtained SR22 insurance in Spokane, it’s crucial to maintain continuous coverage for the required period, typically three years. If you let your policy lapse or cancel it prematurely, your insurance company will notify the DOL, and your license may be suspended again. To avoid this, be sure to:

- Pay your premiums on time

- Renew your policy before it expires

- Inform your insurance provider if you move or change vehicles

- Keep your contact and payment information up to date

The team at Mid-Columbia Insurance is dedicated to helping you maintain your SR22 coverage and avoid any lapses that could jeopardize your driving privileges.

Consequences of Not Having SR-22 Insurance in Spokane

If you’re required to have SR-22 insurance in Spokane and fail to obtain or maintain coverage, you may face serious consequences, such as:

- License suspension or revocation

- Fines and penalties

- Difficulty obtaining future insurance coverage

- Increased insurance rates

- Legal issues, such as being arrested for driving with a suspended license

What Our Customers Are Saying About Us

Frequently Asked Questions

| Question | Answer |

|---|---|

| How long do I need SR22 insurance in Washington? | In most cases, you’ll need to maintain SR22 insurance for three years, but this can vary depending on your specific situation and the reason for your license suspension. |

| Can I get SR-22 insurance without owning a vehicle? | Yes, you can obtain a non-owner SR-22 policy, also known as Broad Form insurance, which covers you when driving vehicles you don’t own. Mid-Columbia Insurance offers both owner and non-owner SR-22 policies. |

| How much does SR22 insurance cost in Spokane? | The cost of SR22 insurance varies depending on factors like your age, driving record, and vehicle type. On average, expect to pay 25-50% more than standard auto insurance rates. Mid-Columbia Insurance works with multiple providers to find you the most affordable rates. |

| What happens if I let my SR-22 insurance lapse? | If you let your SR-22 insurance lapse, your provider will notify the DOL, and your license may be suspended again. You’ll need to pay reinstatement fees and obtain new coverage to regain your driving privileges. The team at Mid-Columbia Insurance can help you avoid lapses and maintain continuous coverage. |

| Can I remove an SR22 filing before the three-year period is up? | In most cases, no. You’ll need to maintain continuous coverage for the entire required period, even if you move out of state or sell your vehicle. Mid-Columbia Insurance will guide you through the process and help you understand your obligations. |

Obtaining and maintaining SR-22 insurance in Spokane may seem daunting, but it’s a necessary step in reinstating your driving privileges after a license suspension. By working with the knowledgeable and dedicated team at Mid-Columbia Insurance, you can find the right coverage at the best price and get back on the road with confidence. Contact them today to learn more about their SR-22 insurance options and start the process of reinstating your license.

Finding Affordable SR22 Insurance in Spokane

Because SR22 insurance is typically required for high-risk drivers, premiums can be more expensive than standard auto insurance. However, there are ways to find more affordable coverage in Spokane:

- Shop around and compare quotes from multiple providers

- Ask about discounts for safe driving, multiple policies, or completing a defensive driving course

- Consider increasing your deductible to lower your monthly premium

- Maintain a clean driving record going forward to qualify for better rates over time

As an independent insurance agency, Mid-Columbia Insurance works with multiple top-rated insurance companies, including Progressive, Dairyland, National General, The General, and Bristol West, to find you the most competitive rates on SR22 insurance in Spokane.

Working with Mid-Columbia Insurance

Navigating the world of SR-22 insurance can be complex and overwhelming, especially if you’re already dealing with the stress of a suspended license. Working with the experienced team at Mid-Columbia Insurance can help you:

- Understand your coverage options and requirements

- Find the most affordable SR-22 insurance policy for your needs

- Ensure your filing is submitted correctly and on time

- Avoid lapses in coverage that could lead to further license suspensions

- Get personalized support and guidance throughout the process

With thousands of 5-star Google reviews, Mid-Columbia Insurance has a proven track record of providing exceptional service and expertise to Spokane drivers in need of SR-22 insurance. Trust their team to help you get back on the road quickly, legally, and affordably.

Get Started with SR22 Insurance in Spokane

If you need SR22 insurance in Spokane, don’t wait – contact Mid-Columbia Insurance today to get started. Our dedicated team is here to help you every step of the way, from comparing quotes to filing your SR22 certificate with the DOL.

With our extensive industry knowledge, personalized service, and commitment to finding the best coverage at the most competitive rates, you can trust Mid-Columbia Insurance to be your partner in getting back on the road legally and responsibly.

Call us at (509)783-5600, visit our office, or click “Get a Quote” to request a quote online to begin the process of obtaining SR22 insurance in Spokane, WA. We look forward to serving you and helping you move forward with confidence.

The insurance you want — At a price you can afford.