Bellevue SR-22 Insurance: Get Back on the Road

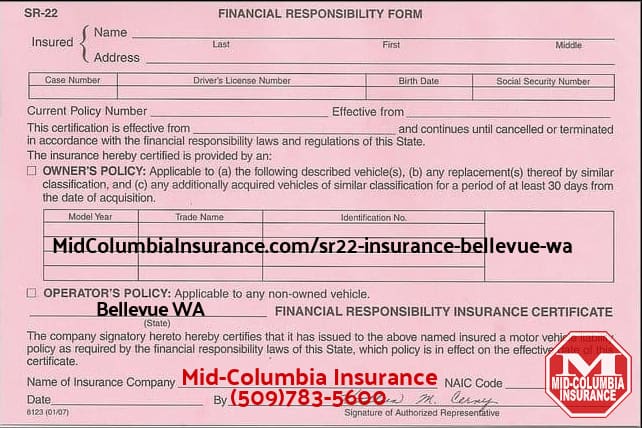

If you’re considered a high-risk driver and in need of SR-22 insurance in Bellevue, Washington, Mid-Columbia Insurance is here to help you navigate the complex process of obtaining this crucial certificate of financial responsibility.

As a trusted, independent insurance agency with over 25 years of experience, we specialize in providing affordable SR-22 coverage to drivers in Bellevue and throughout the Evergreen State.

Our expert agents work with top-rated insurance carriers like Progressive, National General, Dairyland, The General, and Bristol West to find you the best rates and coverage options tailored to your unique needs.

What is SR-22 Insurance?

An SR-22, often referred to as “SR-22 insurance,” is a certificate of financial responsibility required by the Washington State Department of Licensing (DOL) for drivers convicted of serious traffic violations.

This document is proof that is sent to the DOL that you carry the state’s minimum liability coverage, which includes:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

Who Needs SR-22 Insurance in Bellevue, WA?

You may need to obtain an SR-22 certificate if you’ve been convicted of any of the following offenses in Washington:

- DUI (Driving Under the Influence) or DWI (Driving While Intoxicated).

- Reckless driving.

- Causing an accident and not having insurance.

- Accumulating too many traffic violations on your driving record.

- Or having your license suspended or revoked for any other reason.

Request An SR22 Insurance Quote

Disclaimer: By requesting a quote, I am providing my express written consent to Mid-Columbia Insurance to work up an insurance quote for me and to contact me by phone, text message, and email at the phone number and email address provided. Additionally, I acknowledge that I have read, understood, and agree to Mid-Columbia Insurance’s Privacy Policy.What Our Customers Are Saying About Us

How to Get SR-22 Insurance

At Mid-Columbia Insurance, we make the process of getting SR-22 insurance in Bellevue simple and stress-free. Follow these steps to obtain your certificate of financial responsibility and get back on the road:

- Contact our agency and request an SR-22 insurance quote. Our friendly, knowledgeable agents will guide you through the process and answer any questions you may have.

- Choose a policy that meets your needs and budget. We’ll help you compare rates from our top-rated insurance carriers to find the best coverage at the most affordable price.

- Pay your premium and let us handle the rest.

We’ll file your SR-22 certificate electronically with the DOL, ensuring swift processing and reinstatement of your driving privileges.

As agency owner Gary Paulson notes, “At Mid-Columbia Insurance, we understand that everyone makes mistakes. Our goal is to help high-risk drivers in Bellevue and throughout Washington get back on track with affordable, reliable SR-22 coverage.”

How Much Does SR-22 Insurance Cost in Bellevue, WA?

The cost of SR-22 insurance in Bellevue depends on several factors, including your age, driving record, vehicle type, and coverage limits. However, you can expect to pay more for SR-22 coverage than you would for standard auto insurance, as you’re considered a higher risk to insure.

At Mid-Columbia Insurance, we work hard to keep your rates as low as possible. We shop around on your behalf, comparing quotes from Progressive, National General, Dairyland, The General, and Bristol West to find you the most competitive rates. We also offer flexible payment options and discounts to make your SR-22 coverage more affordable.

How Long Do I Need to Maintain SR-22 Insurance in Bellevue, WA?

In most cases, you’ll need to maintain continuous SR-22 coverage for three years from the date you were convicted and lost your license. While you insurance policy is in force, your insurance company will keep your SR-22 on file with the DOL, ensuring you remain in compliance with state requirements.

It’s crucial to keep your SR-22 policy active and avoid any lapses in coverage. If you fail to renew your policy or allow it to cancel, your insurance company is required by law to notify the DOL. This can result in the suspension of your driver’s license and additional fines or penalties.

What Types of SR-22 Insurance Are Available in Bellevue, WA?

At Mid-Columbia Insurance, we offer several types of SR-22 coverage to meet the diverse needs of Bellevue drivers:

- Owner SR-22: This is the most common type of SR-22 insurance, designed for drivers who own their vehicle.

- Non-Owner SR-22: If you don’t own a vehicle but still need to drive occasionally, a non-owner SR-22 policy can provide liability coverage when you rent or borrow a car.

- Broadform SR-22: This is a special policy that covers you while driving owned or non-owned vehicles. Like the non-owner policy it can not have ‘full-coverage’.

Our experienced agents will work with you to determine the best type of SR-22 coverage for your unique situation, ensuring you’re properly protected while meeting Washington state requirements.

Can I Get SR-22 Insurance with a Suspended License?

Yes, you can obtain SR-22 insurance even if your driver’s license is currently suspended. In fact, filing an SR-22 certificate is often a necessary step in the license reinstatement process.

At Mid-Columbia Insurance, we specialize in helping drivers with suspended licenses obtain the SR-22 coverage they need to get back on the road. We’ll guide you through the process, from selecting the right policy to filing your SR-22 certificate with the appropriate state DOL.

What Happens If I Cancel My SR-22 Insurance?

If you cancel your SR-22 insurance policy before the required three-year period ends, your insurance company must notify the Washington State DOL. This will likely result in the suspension of your driver’s license and additional fines or penalties.

To avoid these consequences, it’s essential to maintain continuous SR-22 coverage for the entire mandated period. If you need to switch insurance providers during this time, make sure to have your new policy in place before canceling your current one to prevent any lapses in coverage.

Mid-Columbia Insurance

– Your Trusted SR-22 Insurance Agent

When you need SR-22 insurance in Bellevue, Washington, trust the experts at Mid-Columbia Insurance. With over 25 years of experience helping high-risk drivers obtain affordable, reliable coverage, we’re committed to making the process as simple and stress-free as possible.

Our knowledgeable agents will work with you to find the best SR-22 policy for your needs and budget, comparing rates from top-rated carriers like Progressive, National General, Dairyland, The General, and Bristol West. We’ll also handle the electronic filing of your SR-22 certificate with the appropriate state DOL, ensuring swift processing and reinstatement of your driving privileges.

Don’t let a DUI, reckless driving conviction, or other traffic violation keep you off the road any longer. Call us at (509)783-5600 or click “Get a Quote” for a free SR-22 insurance quote and take the first step toward getting back behind the wheel in Bellevue.

The insurance you want — At a price you can afford.