Seattle SR-22 Insurance: Competitive Rates, Top Carriers

In Seattle, Washington, Mid-Columbia Insurance helps drivers obtain SR-22 insurance quickly and easily. As an independent insurance agency, they work with multiple insurance carriers to find the best coverage options for their clients.

We understand that needing an SR-22 can be stressful, but we’re here to help. Our goal is to make the process as smooth as possible for our clients and get you back on the road legally.

Call Now for Quote!

What is SR-22 Insurance?

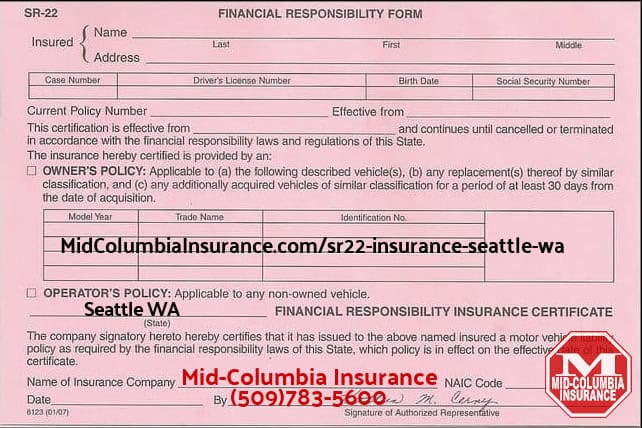

SR-22 insurance is a type of financial responsibility form that proves a high-risk driver carries the minimum liability coverage required by their state. It is not a separate insurance policy but rather an endorsement to an existing auto insurance policy. The SR-22 form is filed by the insurance company on behalf of the driver and serves as a guarantee to the state that the driver is meeting their legal obligations for insurance coverage.

Who Needs SR-22 Insurance?

Drivers may be required to file an SR-22 form for various reasons, most commonly due to driving violations or high-risk behaviors. Some situations that may trigger the need for an SR-22 include:

- DUI or DWI convictions

- Reckless or negligent driving

- Driving without insurance

- Accumulating too many traffic violations or accidents

- Failing to pay court-ordered child support

- Needing to reinstate a suspended license

In Washington state, the Department of Licensing mandates SR-22 filings for certain offenses. The length of time a driver must maintain an SR-22 varies but is typically three years. Mid-Columbia Insurance helps drivers determine their specific requirements and ensures they comply with state regulations.

Request An SR22 Insurance Quote

Disclaimer: By requesting a quote, I am providing my express written consent to Mid-Columbia Insurance to work up an insurance quote for me and to contact me by phone, text message, and email at the phone number and email address provided. Additionally, I acknowledge that I have read, understood, and agree to Mid-Columbia Insurance’s Privacy Policy.What Our Customers Are Saying About Us

How to Obtain SR-22 Insurance

To get SR-22 insurance, drivers must first find an insurance company that offers this service. Not all insurers provide SR-22 filings, so it’s essential to shop around. Mid-Columbia Insurance works with several insurance carriers that specialize in SR-22 coverage, including:

By partnering with these insurance providers, Mid-Columbia Insurance can help drivers find affordable coverage that meets their needs and satisfies the state’s requirements.

A driver must purchase a liability insurance policy that meets or exceeds Washington’s minimum coverage limits:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury Liability (per person) | $25,000 |

| Bodily Injury Liability (per accident) | $50,000 |

| Property Damage Liability | $10,000 |

After starting the policy, the insurance company will file the SR-22 certificate electronically with the state, confirming that the driver has the required insurance. The driver will also receive a copy of the SR-22 for their records.

The Cost of SR-22 Insurance

The cost of SR-22 insurance varies depending on several factors, including the driver’s age, driving record, and location. In general, drivers who require an SR-22 can expect to pay higher premiums than those with clean driving records because they are considered higher risk.

However, the SR-22 filing itself is relatively inexpensive. Most insurance companies charge a one-time fee of $15 to $50 to file the form with the state. This fee is in addition to the cost of the auto insurance policy.

To help drivers find the most affordable coverage, Mid-Columbia Insurance compares rates from multiple insurance carriers. By shopping around, drivers can potentially save hundreds of dollars on their annual premiums while still meeting their legal obligations.

Maintaining SR-22 Insurance

Once an SR-22 is filed, drivers must maintain continuous coverage for the duration of their filing period, which is usually three years in Washington state. If there is a lapse in coverage, even for a short time, the insurance company must notify the Department of Licensing, and the driver’s license may be suspended again.

To avoid complications, drivers should make payments on time and renew their policies before they expire. The insurance company sends reminders to clients when their policies are up for renewal, helping them stay on top of their obligations.

If a driver needs to switch insurance companies during their filing period, they must ensure that there is no gap in coverage. The new insurer will need to file a new SR-22 form with the state, and the driver must, like everyone else, keep proof of insurance with them when driving.

The Benefits of Working with Mid-Columbia Insurance

Navigating the world of SR-22 insurance can be challenging, but Mid-Columbia Insurance makes it easier for drivers in Seattle, Washington. With over 30 years of experience, the agency has the knowledge and expertise to guide clients through the process and answer any questions they may have.

Some of the benefits of working with Mid-Columbia Insurance include:

- Access to multiple insurance carriers that specialize in SR-22 coverage

- Competitive rates and flexible payment options

- Personalized service from knowledgeable insurance agents

- Assistance with license reinstatement and compliance with state regulations

- Convenient online tools for managing policies and making payments

Gary Paulson and his team are committed to helping drivers get back on the road safely and legally. “We know that everyone makes mistakes, and we’re here to help our clients move forward,” he says. “With our extensive network of insurance carriers and our dedication to customer service, we can find solutions that work for every driver’s unique situation.”

Frequently Asked Questions

| Question | Answer |

|---|---|

| Can I get SR-22 insurance if I have a suspended license? | Yes, you can obtain SR-22 insurance with a suspended license. In fact, filing an SR-22 is often a requirement for license reinstatement after a suspension. |

| How do I know if I need SR-22 insurance? | You will typically be notified by the court or the Washington Department of Licensing if you are required to file an SR-22. This notification usually follows a qualifying offense or license suspension. |

| Can I drive someone else’s car with SR-22 insurance? | It depends on your specific SR-22 insurance policy. Some policies only cover you when driving your own vehicle, while others, like non-owner SR-22 insurance, provide coverage when driving any vehicle. |

| How do I get my SR-22 removed after the required period? | Contact your insurance company and request that they remove the SR-22 filing from your policy. They will notify the Department of Licensing that you have fulfilled your SR-22 requirement. |

| Will my insurance rates go back to normal after my SR-22 is removed? | While your rates may decrease after the SR-22 is removed, they may not return to your pre-SR-22 levels. Your rates will depend on your driving record and other factors evaluated by your insurance company. |

| What should I do if I move to another state during my SR-22 period? | Notify your insurance company of your move, as SR-22 requirements vary by state. Your insurer can help you transfer your SR-22 to your new state or cancel it if it’s no longer needed. |

| Can I get SR-22 insurance if I don’t have a car? | Yes, you can obtain non-owner SR-22 insurance if you need to fulfill an SR-22 requirement but don’t own a vehicle. This type of policy covers you when driving rented or borrowed vehicles. |

Mid-Columbia Insurance

– Your Trusted SR-22 Insurance Agent

SR-22 insurance is a necessary step for high-risk drivers who want to reinstate their driving privileges and comply with state laws. While the process may seem daunting, working with an experienced insurance agency like Mid-Columbia Insurance can make it much easier.

By partnering with insurance carriers that specialize in SR-22 coverage, Mid-Columbia Insurance helps drivers in Seattle, Washington, find affordable policies that meet their needs. With personalized service and a commitment to customer satisfaction, the agency ensures that clients have the support they need to navigate the complex world of SR-22 insurance successfully.

Call us at (509)783-5600, visit our office, or click “Get a Quote” to request a quote online to begin the process of obtaining SR22 insurance in Seattle, WA. We look forward to serving you and helping you move forward with confidence.

The insurance you want — At a price you can afford.

Best Places to Visit in Seattle

While navigating the world of SR-22 insurance can be stressful, don’t forget to take some time to explore the beautiful city of Seattle. Here are some of the best places to visit in the Emerald City:

- Pike Place Market: This iconic public market is a must-see for anyone visiting Seattle. Browse the colorful stalls filled with fresh produce, handmade crafts, and unique gifts. Don’t miss the famous fish toss at the Pike Place Fish Market!

- Space Needle: Built for the 1962 World’s Fair, the Space Needle offers stunning panoramic views of the city from its observation deck. Enjoy a meal at the rotating restaurant or simply take in the sights from 520 feet above the ground.

- Chihuly Garden and Glass: This indoor/outdoor museum showcases the breathtaking glass sculptures of world-renowned artist Dale Chihuly. Walk through the galleries and gardens to experience the beauty and creativity of his work.

- Museum of Pop Culture (MoPOP): Formerly known as the Experience Music Project, MoPOP is a must-visit for music and pop culture enthusiasts. Explore interactive exhibits dedicated to music, science fiction, and popular culture, including displays featuring local legends like Jimi Hendrix and Nirvana.

- Washington State Ferries: Take a ferry ride across Puget Sound for a unique perspective of the city and its surrounding islands. Enjoy the fresh sea breeze and keep an eye out for orcas and other marine life.

Remember, while exploring all that Seattle has to offer, make sure you’re properly covered with SR-22 insurance from Mid-Columbia Insurance. Our friendly agents are here to help you find affordable coverage, so you can enjoy your time in the city with peace of mind.